ITC Limited is one of India’s most well-known and diversified conglomerates. From cigarettes to foods, hotels, packaging, and even IT services, ITC has expanded into multiple industries. With such a wide portfolio, it becomes important to analyze how each business unit is performing and contributing to the company’s overall growth.

One of the best tools to study this is the BCG Matrix, also known as the Growth-Share Matrix. In this blog, we will explore the BCG Matrix of ITC in detail and understand where its major businesses stand.

What is the BCG Matrix?

The BCG Matrix is a strategic planning framework developed by the Boston Consulting Group. It helps companies analyze their business units or product lines based on two factors:

- Market Growth Rate (how fast the industry is growing)

- Relative Market Share (how strong the company’s position is in that market)

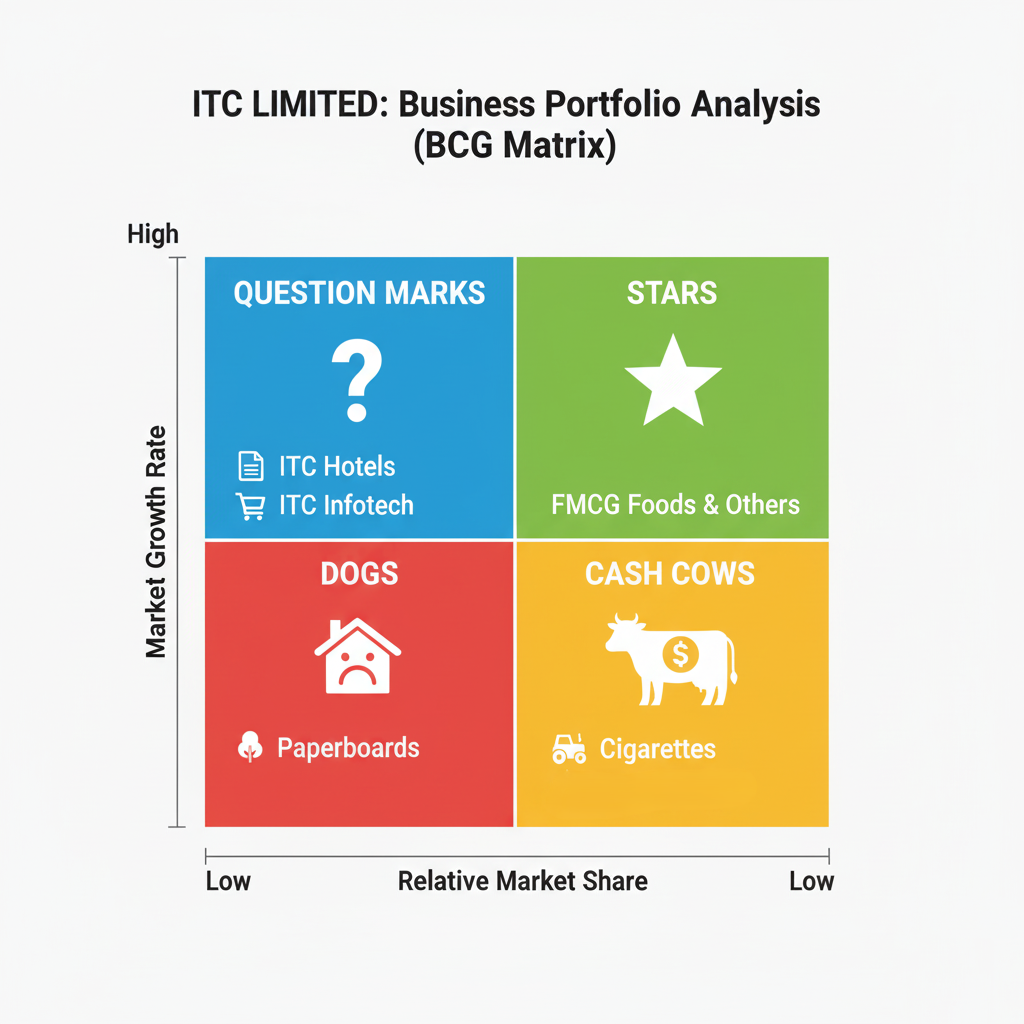

The matrix is divided into four categories:

- Stars: High market share in a high-growth industry.

- Cash Cows: High market share in a low-growth industry.

- Question Marks: Low market share in a high-growth industry.

- Dogs: Low market share in a low-growth industry.

By placing different business units into these categories, companies can decide where to invest, where to divest, and where to focus for future growth.

Overview of ITC Limited

Founded in 1910, ITC began its journey as the Imperial Tobacco Company of India. Over time, it diversified into many industries and became one of the leading conglomerates in India.

Major Business Segments of ITC:

- FMCG

-

-

- Cigarettes

- Packaged Foods (Aashirvaad, Sunfeast, Bingo!, Yippee!)

- Personal Care (Fiama, Vivel, Savlon)

-

- Hotels

-

- Paperboards, Paper, and Packaging

- Agri-Business (e-Choupal, agri-exports)

- Information Technology (ITC Infotech)

This diversification makes ITC an interesting company to analyze through the BCG Matrix.

BCG Matrix of ITC

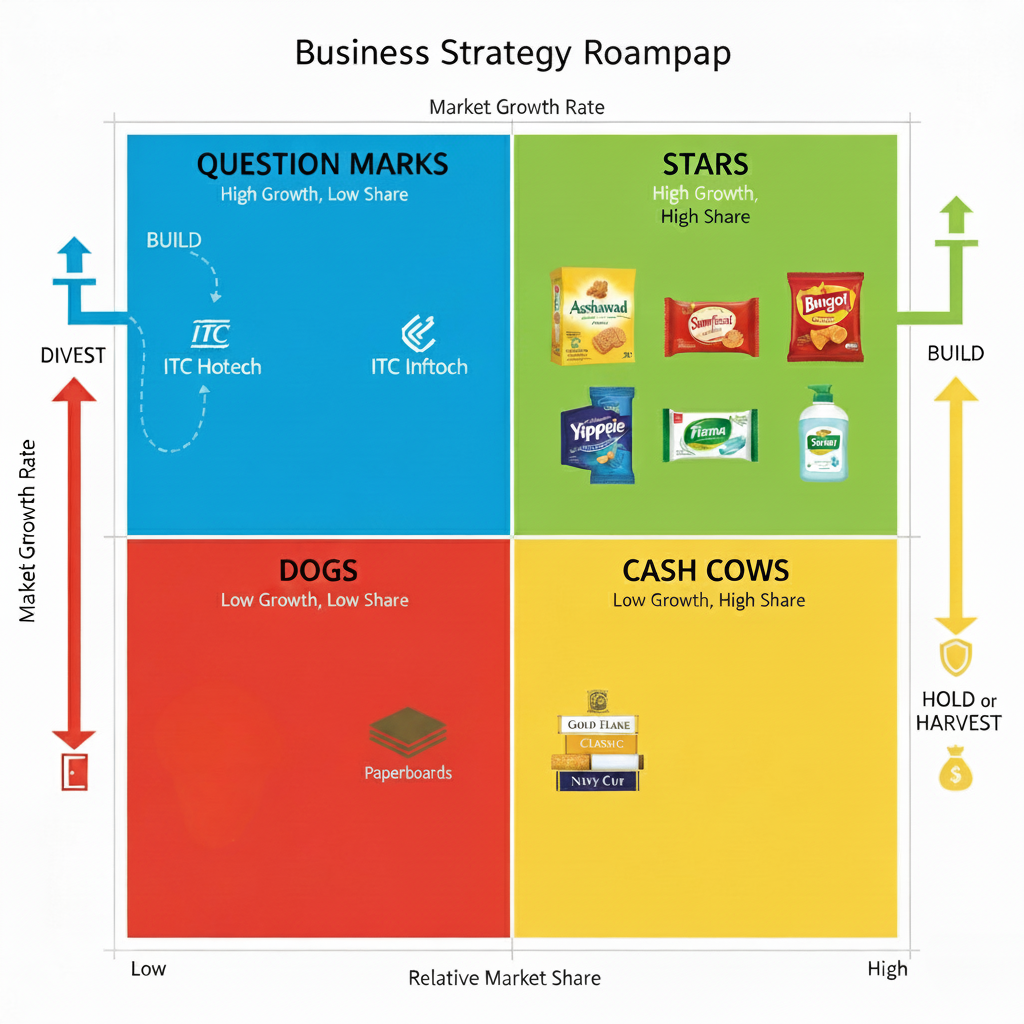

1. Stars (High Market Share, High Growth)

The FMCG Foods Division of ITC has become a star in recent years. Brands like Aashirvaad (flour, spices), Sunfeast (biscuits), Bingo! (snacks), and Yippee! (noodles) are performing very well in India’s rapidly growing packaged food industry.

ITC’s Personal Care brands like Fiama and Savlon are also gaining popularity in a high-growth market. While competition is strong, ITC is making significant investments to strengthen its position in these categories.

Why Stars?

- Growing Indian FMCG sector.

- Increasing consumer demand for packaged foods and personal hygiene products.

- Strong distribution network of ITC.

2. Cash Cows (High Market Share, Low Growth)

ITC’s Cigarettes business is its biggest Cash Cow. Cigarettes like Gold Flake, Classic, and Navy Cut dominate the Indian tobacco market with a very high market share.

Although the overall cigarette industry in India is not growing rapidly (due to health awareness and strict government regulations), ITC continues to generate huge profits from this segment. The strong cash flow from cigarettes helps ITC invest in other businesses like FMCG and Hotels.

Why Cash Cows?

- Dominant market share in Indian tobacco.

- High margins and profitability.

- Consistent revenue despite slow industry growth.

3. Question Marks (Low Market Share, High Growth)

The Hotels business of ITC is considered a Question Mark. The hospitality industry in India has high growth potential, but ITC faces tough competition from players like Taj, Oberoi, and international hotel chains. ITC Hotels has premium properties, but it still struggles to capture a larger share of the overall market.

Another Question Mark is ITC Infotech, the company’s IT services arm. The IT industry in India is booming with companies like TCS, Infosys, and Wipro leading the market. ITC Infotech, however, has a smaller share and faces challenges in scaling up.

Why Question Marks?

- Hotels have growth potential but face strong competition.

- ITC Infotech operates in a growing sector but lacks the dominance of big IT companies.

4. Dogs (Low Market Share, Low Growth)

The Paperboards, Paper, and Packaging segment of ITC can be considered a Dog in the BCG Matrix. Although ITC has a presence in this industry, the overall growth of the paper and packaging sector in India is relatively low. Moreover, rising digitalization and environmental concerns are reducing long-term demand for paper.

While ITC’s sustainable packaging solutions are innovative, the business does not generate the same level of returns as Cigarettes or FMCG.

Why Dogs?

- Low growth industry.

- Limited profitability compared to other ITC businesses.

- Struggles to maintain competitiveness.

Also Check: BCG Matrix of Samsung [Detailed]

Strategic Implications of ITC’s BCG Matrix

From the above analysis, ITC can derive several strategic insights:

- Use Cash Cows (Cigarettes) to fund Stars (FMCG Foods and Personal Care).

- Invest in Question Marks (Hotels and ITC Infotech) to increase market share and convert them into Stars.

- Reposition or limit investment in Dogs (Paper and Packaging) unless new innovations open opportunities.

- Maintain a balanced portfolio to reduce risks and ensure sustainable growth.

Conclusion

The BCG Matrix of ITC highlights the company’s strong reliance on its Cigarettes business as a Cash Cow, while its FMCG division emerges as a growing Star. The Hotels and IT services divisions are Question Marks that need more investment and strategic attention. Meanwhile, the Paper and Packaging segment remains a Dog with limited growth prospects.

ITC’s ability to balance these segments will decide its future growth. By investing in its FMCG Stars and nurturing its Question Marks, ITC can continue to strengthen its position as one of India’s leading conglomerates.

FAQs

1. What is the main Cash Cow of ITC?

The Cigarettes business is ITC’s main Cash Cow, generating consistent profits despite low industry growth.

2. Why are ITC Foods considered a Star?

Because ITC’s food brands like Aashirvaad, Sunfeast, Bingo!, and Yippee! are growing rapidly in India’s FMCG sector.

3. Which ITC business segment is facing the most challenges?

The Paperboards, Paper, and Packaging segment faces challenges due to low growth and reduced demand.

4. How does the BCG Matrix help in ITC’s strategy?

It helps ITC identify which businesses to invest in, which to divest, and how to allocate resources effectively.

5. Is ITC’s diversification strategy successful?

Yes, ITC’s diversification has reduced its dependence on cigarettes, with FMCG emerging as a strong growth driver.

Passionate about blogging and focused on elevating brand visibility through strategic SEO and digital marketing. Always tuned in to the latest trends, I’m dedicated to maximizing engagement and delivering measurable ROI in the dynamic world of digital marketing. Let’s connect and unlock new opportunities together!

![BCG Matrix of ITC [Detailed]](https://admindia.org/wp-content/uploads/2025/09/BCG-Matrix-of-ITC-Detailed.jpg)