Summary

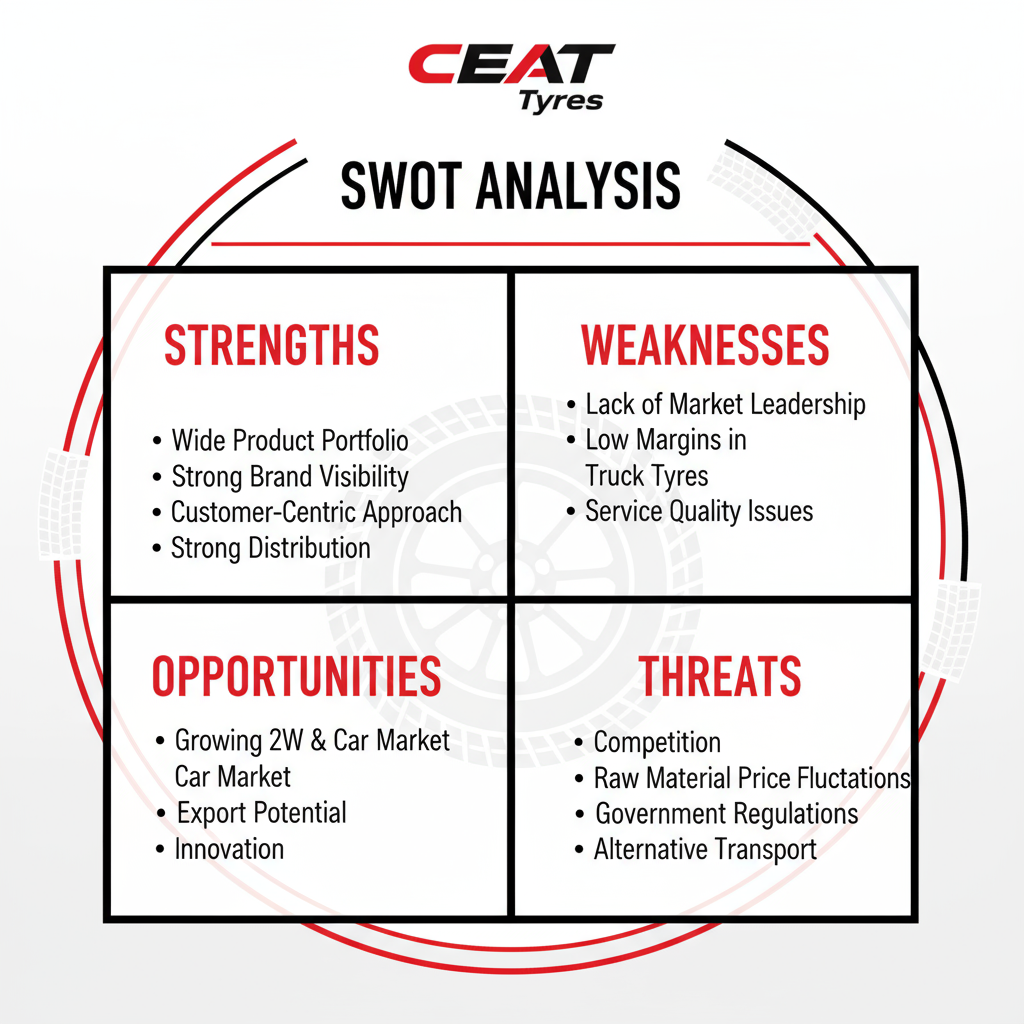

CEAT Tyres is one of India’s leading tyre manufacturers with a strong brand presence, diversified product range, and a customer-focused approach. This SWOT analysis examines CEAT’s strengths, weaknesses, opportunities, and threats in 2025, highlighting the factors that influence its market position and growth prospects. Understanding these elements helps industry analysts, investors, and customers gain a clear view of CEAT’s current performance and future potential.

Company Overview

CEAT Tyres was founded in 1958 in Mumbai, India, and later became part of the RPG Group in 1982. The company manufactures and sells tyres for a wide range of vehicles, including two-wheelers, passenger cars, commercial vehicles, farm equipment, and specialty vehicles.

With a production capacity of approximately 95,000 tyres per day, CEAT has established itself as a reliable tyre manufacturer. The company’s annual turnover is nearly USD 1.4 billion (2024), and it employs around 8,000 people. CEAT exports to over 100 countries, emphasizing its global reach. The brand is well-known for quality products, supported by its tagline “Take It On” and numerous ISO certifications, including ISO/TS 16949:2002.

CEAT’s product range includes tyres for motorcycles, scooters, passenger cars, trucks, and heavy vehicles. Notable models include CEAT Zoom, CEAT Rhino, Buland, F67, Secura Sport, and Gripp. The company’s distribution network is extensive, reaching urban and rural markets across India.

Strengths of CEAT Tyres

CEAT has several internal strengths that provide a competitive advantage in the Indian tyre market. These strengths highlight its operational efficiency, product quality, and customer-oriented approach.

Wide Product Portfolio

CEAT offers a diverse product range across different vehicle categories. The motorcycle segment includes CEAT Zoom, CEAT Zoom Tubeless, F67, and Secura Sport. For scooters, CEAT produces Gripp and Zoom D tyres. Passenger car tyres include Czar AT, Czar HT, Rhino, and Rhino TQ. Commercial vehicle tyres, such as Buland and Buland Mile XL RIB, cater to trucks, buses, and three-wheelers like Anmol SL. CEAT also manufactures farm and agricultural tyres, as well as specialty tyres for mining, construction, and port applications.

This wide portfolio allows CEAT to serve multiple market segments and meet the varying needs of customers. It also helps reduce dependency on a single product line, improving business stability.

High Brand Visibility

CEAT has built strong brand recognition in India over the decades. Consistent marketing campaigns, sponsorships, and advertising efforts have made CEAT a household name. The brand communicates a value-driven proposition, emphasizing safety, durability, and performance. High brand visibility strengthens customer trust and loyalty, providing CEAT with a competitive edge.

Customer-Centric Approach

CEAT focuses on customer feedback to develop products that meet market demands. The company prioritizes driving safety, comfort, and performance in its tyres. CEAT frequently updates its product designs to match evolving customer needs, including tubeless tyres, high-grip tyres, and advanced radial technologies. This customer-oriented approach enhances brand loyalty and drives repeat purchases.

Strong Distribution Network

CEAT follows an FMCG-style distribution model with a layered dealer network. Products are sold through dealers who supply sub-dealers, ensuring deep market penetration. This distribution system allows CEAT to reach remote areas and maintain a consistent supply chain. Extensive distribution also helps the brand respond to market demand efficiently.

ISO Certifications & Quality Standards

CEAT was the first tyre company in India to achieve ISO/TS 16949:2002 certification, which combines ISO 9000 and QS 9000 standards. The company also ensures that its vendors are ISO certified. These quality certifications indicate CEAT’s commitment to high standards, building customer confidence and supporting international exports.

Marketing and Promotions

CEAT has engaged in multiple innovative marketing campaigns, including the Nimbu Mirchi campaign, which captured attention effectively. Advertisements focus on highlighting tyre safety, performance, and durability. Continuous marketing efforts maintain brand visibility and attract new customers while reinforcing existing customer loyalty.

Weaknesses of CEAT Tyres

Despite its strengths, CEAT has some internal weaknesses that limit its market performance and growth. Addressing these weaknesses is critical for sustaining competitiveness.

Lack of Market Leadership

While CEAT has a strong brand presence, it does not lead in any particular segment. Competitors like Apollo Tyres, JK Tyres, and Michelin dominate specific categories. Lack of market leadership reduces CEAT’s bargaining power and influence over market trends.

Low Margins in Truck Radial Tyres

The truck radial tyre segment faces intense competition, which reduces profit margins. CEAT’s focus on this segment results in high operational costs and low revenue growth. Limited profitability in key areas can restrict investments in innovation and expansion.

Focus on Multiple Segments

CEAT operates across multiple product segments, including motorcycles, scooters, passenger cars, commercial vehicles, and specialty tyres. While diversification reduces risk, it also dilutes focus. The company may struggle to compete with rivals who specialize in specific categories, leading to reduced market share in certain segments.

After-Sales Service Challenges

CEAT has a large network of service outlets, but quality varies across locations. Customers have reported issues related to service quality and personnel behavior. Poor after-sales service can affect brand reputation and customer retention, especially in premium segments where service quality is critical.

Opportunities for CEAT Tyres

External opportunities provide CEAT with potential areas for growth and expansion. Leveraging these opportunities can enhance revenue, market share, and brand recognition.

Growing Two-Wheeler and Passenger Car Market

India’s two-wheeler and passenger car markets are expanding steadily. Rising urbanization, increasing disposable incomes, and demand for safer driving experiences drive this growth. CEAT can capitalize on this trend by offering high-performance tyres tailored to these vehicles.

Expanding Export Potential

Although CEAT exports to over 100 countries, its global market share is still small compared to international leaders. Expanding exports can increase revenue and brand recognition globally. Focusing on regions with growing automotive demand can provide sustainable growth opportunities.

Also Read: SWOT Analysis of Rolls-Royce

Improved Infrastructure in India

Government initiatives and urban development projects are improving road infrastructure across India. Better roads increase demand for heavy vehicle tyres and enhance tyre durability requirements. CEAT can leverage these developments to introduce tyres designed for long-lasting performance on new roads.

Innovation & Technological Advancement

CEAT has opportunities to innovate in product design and technology. Developing high-grip tyres, eco-friendly materials, and advanced radial and tubeless designs can attract safety-conscious and performance-focused customers. Innovation can also help CEAT differentiate from competitors and capture niche markets.

Threats to CEAT Tyres

External threats can negatively impact CEAT’s operations and market position. Identifying these threats allows the company to prepare mitigation strategies.

Stiff Competition

CEAT faces strong competition from domestic brands like Apollo Tyres and JK Tyres, as well as international players like Michelin, Goodyear, Bridgestone, Dunlop, and Cooper. Competitive pricing, quality, and product variety make it challenging for CEAT to maintain market share.

Fluctuating Raw Material Prices

The cost of raw materials, including rubber, carbon black, steel, and chemicals, fluctuates regularly. These variations affect manufacturing costs and product pricing. Rising material costs can reduce profit margins if the company is unable to pass costs to customers.

Government Regulations

Changes in import/export duties, taxes, and environmental regulations can influence tyre prices and demand. Policy shifts related to automobile manufacturing or fuel efficiency standards can impact CEAT’s product planning and profitability.

Alternative Transportation & Market Disruptions

The expansion of metro systems, monorails, and public transportation reduces reliance on private vehicles. Reduced automobile usage could lower tyre demand. Additionally, cheaper imports from countries like China may pressure CEAT’s pricing strategy.

Exchange Rate Fluctuations

CEAT exports to multiple countries, making it vulnerable to currency exchange rate fluctuations. Sudden changes in currency values can affect export revenues and overall profitability.

Conclusion

CEAT Tyres is a well-established brand with a diversified product range, strong distribution network, and high customer recognition. Its strengths include a wide product portfolio, ISO certifications, customer-focused products, and effective marketing campaigns.

Weaknesses such as lack of market leadership in specific segments, low margins in truck radial tyres, diluted focus across multiple segments, and inconsistent after-sales service must be addressed.

Opportunities in growing two-wheeler and passenger car markets, expanding exports, improved infrastructure, and technological innovation provide avenues for growth. However, CEAT must navigate threats from stiff competition, fluctuating raw material prices, government regulations, alternative transport options, and currency exchange risks.

By focusing on segment-specific strategies, improving after-sales services, and investing in innovation, CEAT can strengthen its position in India’s tyre industry and grow its international presence.

FAQs

What is CEAT’s main strength?

CEAT’s main strength is its wide product portfolio, strong brand visibility, and customer-focused approach.

Does CEAT have a strong international presence?

CEAT exports to over 100 countries, but its international market share is smaller than global tyre leaders.

What are the biggest challenges for CEAT Tyres?

The main challenges are stiff competition, low margins in truck radial tyres, and inconsistent after-sales service.

What opportunities exist for CEAT in India?

Opportunities include the growing two-wheeler and passenger car markets, infrastructure improvements, and rising demand for safer tyres.

How can CEAT tackle raw material cost fluctuations?

CEAT can reduce cost risks through efficient production, long-term supplier contracts, and supply chain optimization.

Why is CEAT not a market leader in any segment?

CEAT operates across multiple segments, which dilutes its focus, allowing competitors to dominate specific categories.

A digital marketer with a strong focus on SEO, content creation, and AI tools. Creates helpful, easy-to-understand content that connects with readers and ranks well on search engines. Loves using smart tools to save time, improve content quality, and grow online reach.