Apple Inc. is one of the most powerful and recognized technology companies in the world. From the launch of the first iPhone to the latest innovations in wearables and services, Apple has built an ecosystem that influences millions of people globally.

But how do we analyze Apple’s massive product portfolio in a structured way? One useful tool is the BCG Matrix.

The BCG Matrix helps us understand which Apple products are generating revenue, which ones have growth potential, and which ones may not be worth investing in. In this blog, we will explore the complete BCG Matrix of Apple, breaking down its products into Stars, Cash Cows, Question Marks, and Dogs.

What Is BCG Matrix?

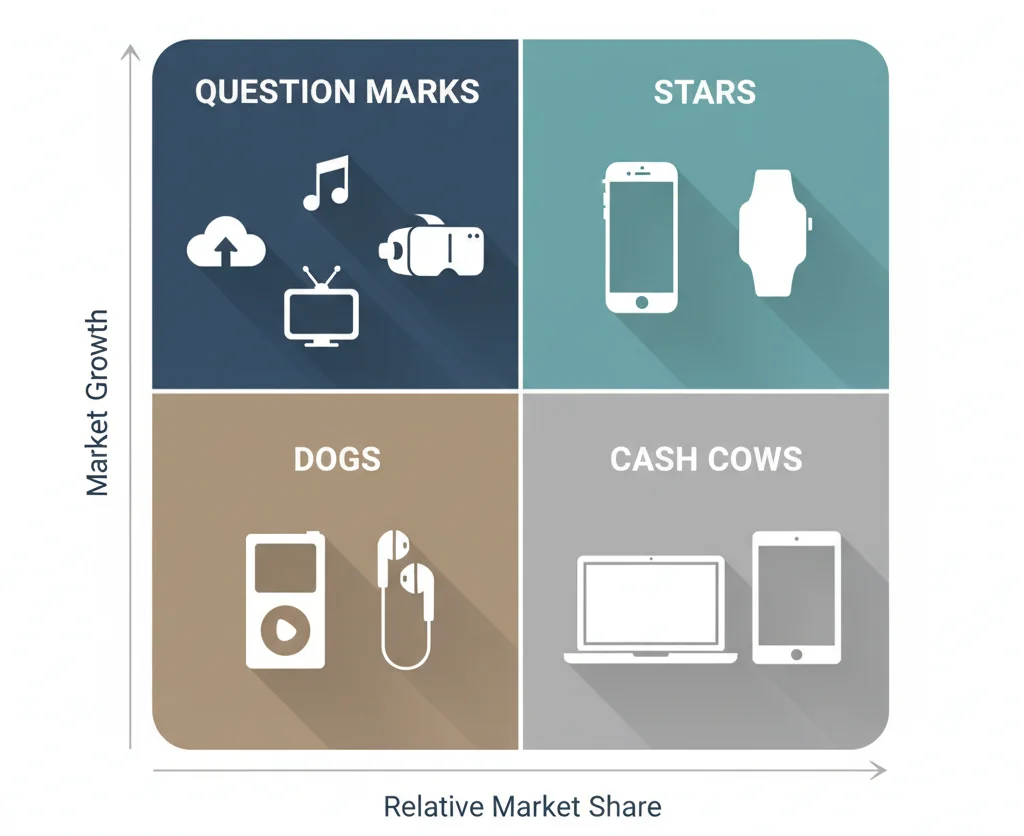

The BCG Matrix, developed by the Boston Consulting Group, is a strategic tool that categorizes a company’s products into four quadrants based on market growth rate and market share.

- Stars: Products with high market share in high-growth industries. They need heavy investment but can become future Cash Cows.

- Cash Cows: Products with high market share in low-growth industries. They generate steady cash flow with little investment.

- Question Marks: Products in high-growth industries with low market share. They need resources but face uncertainty.

- Dogs: Products with low market share in low-growth industries. They often drain resources and have limited potential.

This matrix is important because it helps companies decide where to invest, divest, or develop further.

Apple’s Business and Product Portfolio Overview

Before applying the BCG Matrix, let’s quickly look at Apple’s core product categories:

- iPhone: The flagship product driving Apple’s global revenue.

- iPad: A pioneer in tablets with strong demand across education and business.

- Mac: Apple’s line of laptops and desktops with loyal customer base.

- Apple Watch: Leader in the smartwatch and wearable category.

- AirPods: Highly successful in the wireless earphone segment.

- Apple Services: Includes iCloud, Apple Music, App Store, Apple TV+, and more.

- Other Products: Vision Pro, HomePod, and accessories.

BCG Matrix of Apple: Complete Analysis

1. Stars (High Growth, High Market Share)

- iPhone

-

-

- The iPhone is Apple’s biggest Star. It dominates the smartphone industry, generates the highest revenue, and enjoys strong brand loyalty.

- Despite competition from Samsung and other Android brands, iPhone sales continue to grow, especially with new model launches.

-

- Apple Watch

-

- Apple Watch leads the smartwatch market globally.

- With health and fitness becoming more important, demand for wearables is growing rapidly.

2. Cash Cows (Low Growth, High Market Share)

- Mac

-

-

- The Mac has a stable market presence and consistent demand, especially in education and creative industries.

- Growth is slower compared to other segments, but Mac remains highly profitable.

-

- iPad

-

- Once a revolutionary product, the iPad now competes in a mature market.

- While growth has slowed, it continues to generate steady revenue for Apple.

3. Question Marks (High Growth, Low Market Share)

- Apple TV+

-

-

- Apple’s streaming service is in a high-growth industry but faces tough competition from Netflix, Disney+, and Amazon Prime.

- Its future depends on how well Apple invests in exclusive content.

-

- Apple Vision Pro

-

-

- Apple’s entry into AR/VR is exciting but uncertain.

- The mixed-reality industry has potential but is still in its early stages.

-

- HomePod

-

- Competing with Amazon Alexa and Google Nest, Apple’s smart speaker has yet to capture significant market share.

4. Dogs (Low Growth, Low Market Share)

- iPod

-

-

- Once a revolutionary product, the iPod is now obsolete and officially discontinued.

- It represents a typical Dog in the BCG Matrix.

-

- Some Accessories

-

- Minor accessories that do not contribute much to Apple’s revenue and have limited growth potential fall into this category.

Insights from Apple’s BCG Matrix

- Apple’s Stars (iPhone, Apple Watch) show where the company should continue to invest heavily.

- Its Cash Cows (Mac, iPad) provide the steady cash flow needed to support innovation in other areas.

- The Question Marks (Apple TV+, Vision Pro, HomePod) need strategic decisions—either to invest aggressively or exit the market.

- The Dogs (iPod, niche accessories) highlight products Apple has already phased out or should minimize focus on.

Advantages of Using BCG Matrix for Apple

- Helps Apple allocate resources to the right products.

- Provides a clear view of product lifecycle and positioning.

- Allows better decision-making for innovation and diversification.

- Ensures balance between current profits and future growth.

Limitations of the BCG Matrix in Apple’s Context

- Oversimplification: The matrix does not capture the complexity of Apple’s ecosystem.

- Ignores synergy: Many Apple products work together (e.g., iPhone + AirPods + Apple Watch).

- Static view: The market is dynamic, and product positions can change quickly.

- External factors: Competition, regulations, and global economics are not considered.

Conclusion

The BCG Matrix of Apple shows us how the company manages a diverse product portfolio.

- Stars like iPhone and Apple Watch continue to dominate and drive growth.

- Cash Cows like Mac and iPad provide stable revenue streams.

- Question Marks like Vision Pro and Apple TV+ represent Apple’s bets on the future.

- Dogs like iPod remind us that even the biggest innovations eventually fade.

By using the BCG Matrix, we can better understand Apple’s strategy and how it balances between today’s profits and tomorrow’s innovations.

FAQs

1. What is Apple’s Cash Cow product?

The Mac and iPad are Apple’s Cash Cows, generating consistent revenue with slower growth.

2. Why is iPhone considered a Star in Apple’s BCG Matrix?

The iPhone dominates the smartphone market with high growth and high market share.

3. Which Apple products fall under the Question Mark category?

Apple TV+, Vision Pro, and HomePod are in the Question Mark quadrant due to uncertainty and strong competition.

4. How does the BCG Matrix help Apple in decision-making?

It helps Apple decide which products to invest in, which to maintain, and which to phase out.

5. Is the BCG Matrix still relevant for modern companies like Apple?

Yes, though it has limitations, the BCG Matrix remains a useful tool for understanding product portfolios.

Passionate about blogging and focused on elevating brand visibility through strategic SEO and digital marketing. Always tuned in to the latest trends, I’m dedicated to maximizing engagement and delivering measurable ROI in the dynamic world of digital marketing. Let’s connect and unlock new opportunities together!