Summary

The BCG Matrix of Pharmaceutical Company provides a detailed strategic framework to evaluate how different divisions, drug categories, and product lines perform in a rapidly evolving healthcare market. The Boston Consulting Group (BCG) Matrix, also known as the Growth-Share Matrix, is widely used in the pharmaceutical sector to analyze the balance between mature, profitable drugs and innovative, high-growth treatments.

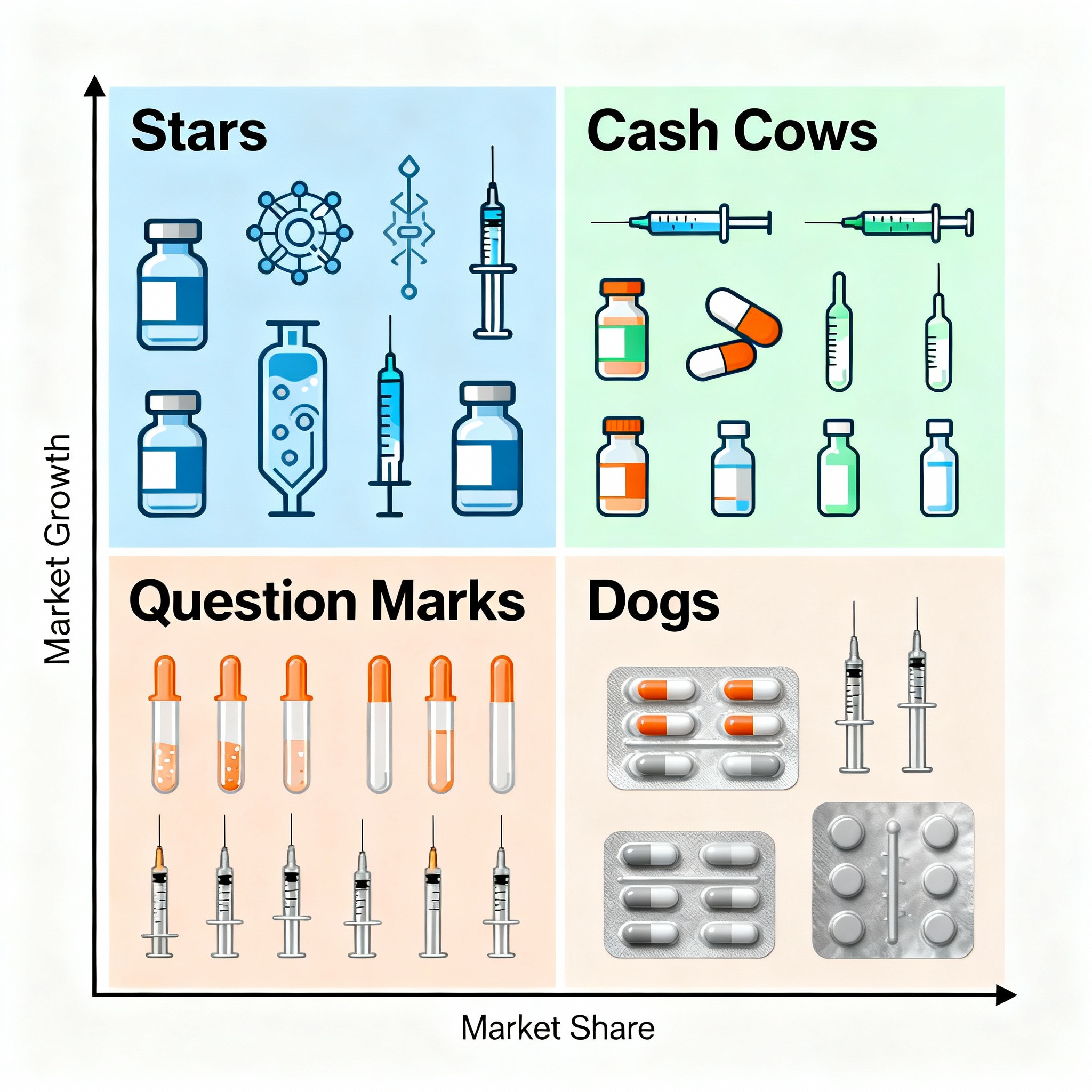

This comprehensive analysis explores how pharmaceutical companies categorize their products into four key quadrants—Stars, Cash Cows, Question Marks, and Dogs—based on market growth rate and relative market share. The blog also explains how the BCG Matrix helps pharma companies allocate resources efficiently, manage R&D portfolios, and make strategic decisions for long-term growth and innovation.

By the end of this descriptive and informative blog, you will understand how the BCG Matrix of a pharmaceutical company serves as a roadmap for sustainable success in an industry driven by innovation, regulation, and competition.

The pharmaceutical industry is one of the most research-intensive and competitive sectors in the world. It plays a critical role in healthcare, developing life-saving drugs and therapies that address a wide range of diseases. However, success in this industry is not only determined by scientific innovation but also by effective portfolio management.

Pharmaceutical companies manage hundreds of products, each at different stages of their life cycle. Some drugs are blockbusters generating billions in revenue, while others are newly launched with uncertain futures. To manage this diversity, companies rely on strategic tools like the BCG Matrix, which helps them identify where to invest, where to maintain, and where to withdraw.

The BCG Matrix of a pharmaceutical company provides a clear view of how products and therapeutic divisions perform in terms of market growth and relative market share. This helps in determining whether a company’s focus should be on developing new molecules, marketing existing drugs, or phasing out outdated products.

What is the BCG Matrix

The Boston Consulting Group (BCG) Matrix is a portfolio management framework that analyzes business units or products based on two dimensions:

- Market Growth Rate: Reflects the potential or attractiveness of the market segment in which the drug or product operates.

- Relative Market Share: Indicates how strong or dominant a company’s product is compared to its competitors in that market.

Based on these two dimensions, the matrix classifies businesses into four quadrants:

- Stars: High market share in high-growth markets.

- Cash Cows: High market share in low-growth markets.

- Question Marks: Low market share in high-growth markets.

- Dogs: Low market share in low-growth markets.

For pharmaceutical companies, this matrix helps determine which drugs to prioritize, which therapeutic areas to expand, and which to phase out.

Importance of the BCG Matrix in the Pharmaceutical Industry

The pharmaceutical industry is characterized by long product development cycles, high R&D costs, strict regulations, and intense competition. The BCG Matrix offers several strategic benefits to pharma companies:

Resource Allocation

Pharmaceutical firms must decide how to distribute budgets between R&D, marketing, and production. The BCG Matrix helps allocate resources effectively between mature products and emerging opportunities.

Portfolio Optimization

It ensures a balanced mix of drugs across different stages of growth—some providing stable profits and others driving innovation.

Strategic Decision-Making

By identifying which drugs or therapeutic areas to invest in, expand, or discontinue, companies can enhance profitability and sustainability.

Lifecycle Management

The matrix assists in tracking the life cycle of drugs—from development and introduction to maturity and decline—helping companies plan transitions smoothly.

Risk Management

Pharma companies face high risks due to patent expirations, regulatory changes, and market volatility. The BCG Matrix helps diversify risks across multiple product categories.

Through these advantages, the BCG Matrix becomes an essential tool for maintaining competitiveness in the complex pharmaceutical landscape.

Detailed BCG Matrix Analysis of a Pharmaceutical Company

To understand how the BCG Matrix applies to a pharmaceutical company, let’s explore each quadrant in detail.

Stars – High Market Share, High Market Growth

In the pharmaceutical industry, Star products are blockbuster drugs or therapies that dominate fast-growing therapeutic markets. These drugs often represent cutting-edge innovations or address high-demand conditions such as diabetes, oncology, cardiovascular diseases, or immunology.

In the pharmaceutical industry, Star products are blockbuster drugs or therapies that dominate fast-growing therapeutic markets. These drugs often represent cutting-edge innovations or address high-demand conditions such as diabetes, oncology, cardiovascular diseases, or immunology.

Characteristics of Stars:

- Strong market share and brand recognition

- Operate in high-growth therapeutic segments

- Require continuous investment in marketing and R&D

- Often lead to high revenue potential

Examples of Star Products in Pharma:

- Cancer therapies such as Keytruda (Merck) and Opdivo (Bristol Myers Squibb)

- COVID-19 and mRNA-based vaccines such as Comirnaty (Pfizer-BioNTech)

- Diabetes drugs like Ozempic (Novo Nordisk)

These products are not only profitable but also drive innovation within the company. For example, the rise of biologics and gene therapy has created massive opportunities for pharmaceutical firms investing in next-generation technologies.

Strategic Approach for Stars:

Companies should continue heavy investment in these drugs through research, clinical trials, and market expansion. They should also focus on maintaining regulatory compliance and building manufacturing capacity to meet global demand.

Cash Cows – High Market Share, Low Market Growth

Definition:

Cash Cow products are well-established drugs that dominate mature markets with little growth potential. These products have stable demand and generate steady cash flow, often used to fund R&D for new drugs.

Characteristics of Cash Cows:

- High market share but low market growth

- Require minimal investment

- Generate consistent revenue and profitability

- Often protected by brand loyalty even after patent expiry

Examples of Cash Cow Products:

- Pain relief and anti-inflammatory drugs such as Aspirin (Bayer) and Ibuprofen (Advil)

- Cardiovascular drugs like Lipitor (Pfizer), which dominated cholesterol management before patent expiry

- Generic versions of popular drugs that maintain a loyal customer base

In the pharmaceutical industry, these Cash Cows are critical to a company’s financial stability. Although the market growth is slow, they often fund innovation and expansion into new therapeutic areas.

Strategic Approach for Cash Cows:

Companies should focus on maximizing efficiency in manufacturing and distribution. Marketing efforts should emphasize brand trust and quality. Cash Cows also provide resources to support R&D in high-growth segments such as oncology and biotech.

Question Marks – Low Market Share, High Market Growth

Question Marks, also known as “Problem Children,” represent newly launched drugs or emerging therapeutic areas with high market potential but low current market share. These are risky yet potentially rewarding investments.

Characteristics of Question Marks:

- Operate in fast-growing markets but have uncertain performance

- Require significant R&D and marketing expenditure

- Carry both opportunities and risks

- Could either become Stars or fail to gain traction

Examples of Question Marks in the Pharma Sector:

- Gene therapies and precision medicines that are in early stages of adoption

- Vaccines targeting emerging diseases

- New drug categories in mental health, obesity management, or rare disorders

For instance, gene therapy is a high-growth market, but only a few companies currently have significant market share. Firms investing in this area could see substantial rewards if their therapies succeed.

Strategic Approach for Question Marks:

Companies should analyze each product’s long-term potential carefully. Strategic partnerships, collaborations, and acquisitions can help improve market position. However, if a drug shows limited commercial viability, divestment may be a better option.

Dogs – Low Market Share, Low Market Growth

Dogs in the pharmaceutical industry are drugs or products that have low market share and limited growth potential. They often include outdated drugs, products nearing patent expiration, or those facing strong competition from generics.

Dogs in the pharmaceutical industry are drugs or products that have low market share and limited growth potential. They often include outdated drugs, products nearing patent expiration, or those facing strong competition from generics.

Characteristics of Dogs:

- Low profitability or even losses

- Operate in saturated markets

- Minimal innovation or differentiation

- Declining sales and limited relevance

Examples of Dogs:

- Older antibiotics replaced by more effective treatments

- Branded drugs that lost exclusivity and now face generic competition

- Drugs for diseases with declining prevalence or better preventive measures

For example, traditional antibiotics that once generated massive revenue now contribute little to overall profitability because of the rise of antibiotic resistance and newer alternatives.

Strategic Approach for Dogs:

Pharma companies often phase out or sell these products to focus on more profitable areas. However, in certain cases, such products may still serve niche markets or emerging economies where affordability is a key factor.

Also Read: BCG Matrix for Service Industry

Strategic Insights from the BCG Matrix of a Pharmaceutical Company

The BCG Matrix provides crucial insights into how pharmaceutical companies manage complex portfolios:

Balanced Growth

A healthy portfolio contains a mix of Stars for innovation, Cash Cows for stability, and Question Marks for future opportunities.

Innovation as a Growth Driver

Continuous research in biotechnology, genomics, and digital health helps companies move products from Question Marks to Stars.

Dependence on R&D and Patents

Patent life plays a critical role in determining the position of a drug within the BCG Matrix. Once patents expire, Stars or Cash Cows can quickly shift into Dogs.

Global Diversification

By expanding into emerging markets, pharmaceutical companies can extend product lifecycles and maximize profitability.

Sustainability Focus

Companies investing in green manufacturing and ethical drug development gain long-term strategic advantages, turning Question Marks into future Stars.

Challenges in Applying the BCG Matrix to the Pharmaceutical Industry

While the BCG Matrix is valuable, the pharmaceutical sector presents unique complexities:

- Long Product Development Cycles: Drug development takes years, making it difficult to categorize products based on short-term growth.

- Regulatory Dependencies: Approvals from bodies like the FDA or EMA can delay or alter growth trajectories.

- Patent Expiry Risks: Patent cliffs can quickly shift products from Stars to Dogs.

- High R&D Costs: Heavy investment requirements make profitability hard to achieve for emerging products.

- Ethical Considerations: Decisions to divest or discontinue certain drugs may conflict with healthcare priorities.

Despite these challenges, the BCG Matrix remains a vital strategic tool for aligning innovation with profitability in pharmaceutical businesses.

Conclusion

The BCG Matrix of a Pharmaceutical Company (2025) provides a clear, structured way to evaluate a diverse drug portfolio. It helps companies balance innovation with financial sustainability while managing market risks and opportunities.

Star products such as breakthrough biologics and oncology treatments drive innovation and long-term growth.

Cash Cows like established chronic disease drugs provide consistent revenue and support R&D investments.

Question Marks such as emerging gene therapies and vaccines represent the future of the industry, requiring strategic focus and capital.

Dogs, including outdated or generic-saturated drugs, highlight areas for cost reduction or exit.

By effectively applying the BCG Matrix, pharmaceutical companies can make informed decisions that enhance profitability, improve healthcare outcomes, and maintain competitiveness in an ever-evolving market.

FAQs

What is the BCG Matrix in the pharmaceutical industry?

The BCG Matrix in the pharmaceutical industry categorizes drugs or divisions based on market growth and market share to guide investment and strategic decisions.

Which products are considered Stars in pharma companies?

Blockbuster drugs, biologics, and innovative therapies in high-demand markets such as oncology, diabetes, and vaccines are typically Stars.

What are Cash Cows in the pharmaceutical sector?

Established, mature drugs that generate consistent profits in low-growth markets, such as cardiovascular or pain relief medications, are considered Cash Cows.

Why are Question Marks important in pharma companies?

They represent new drugs and technologies with high growth potential but uncertain success. Investing in the right Question Marks ensures future growth.

What are examples of Dogs in pharmaceutical companies?

Outdated drugs, those facing patent expiration, or products losing demand due to generics and newer alternatives are considered Dogs.