Samsung is one of the most powerful and recognized brands in the world. From smartphones and televisions to semiconductors and home appliances, Samsung has built a diverse business portfolio that touches almost every corner of the technology industry.

But with such a wide range of products, how does Samsung decide where to invest more, what to maintain, and which business units to slowly phase out? One of the most effective tools used for this type of strategic decision-making is the BCG Matrix.

In this blog, we will take a deep dive into the BCG Matrix of Samsung, exploring where its different business segments stand and what this means for the company’s future.

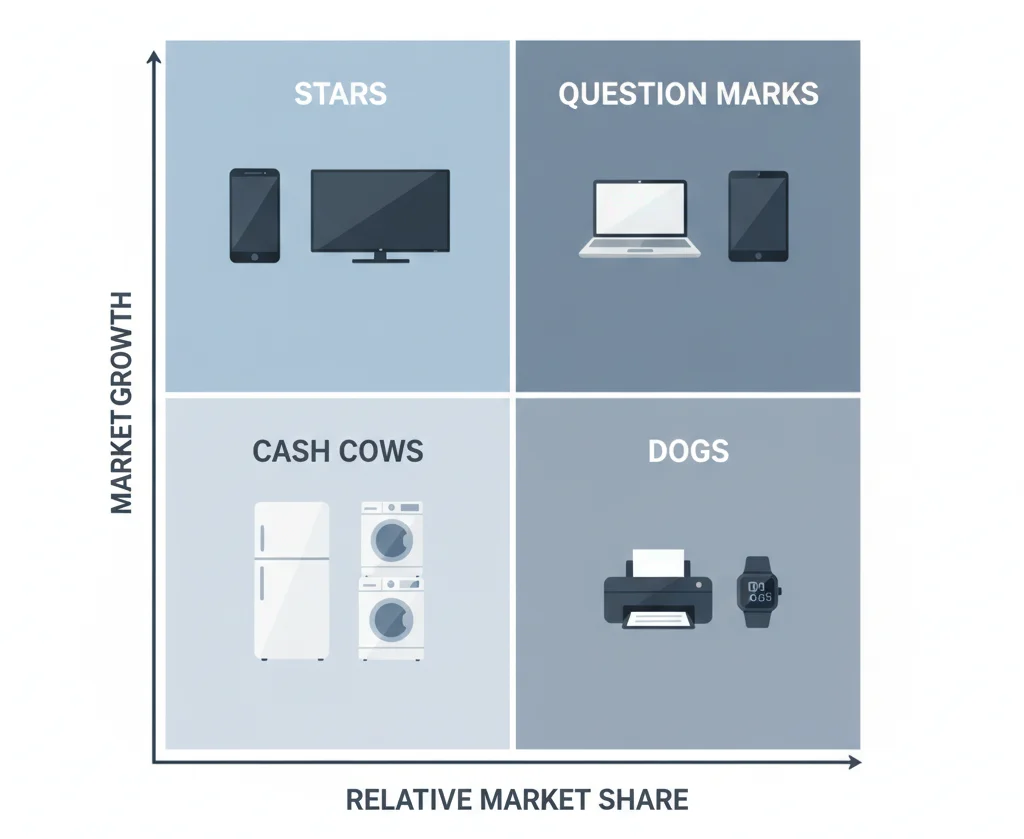

What is the BCG Matrix?

The BCG Matrix (Boston Consulting Group Matrix) is a strategic tool that helps companies analyze their product portfolio. It categorizes products or business units into four groups based on market share and market growth:

- Stars – High market share in a high-growth market.

- Cash Cows – High market share in a low-growth market.

- Question Marks – Low market share in a high-growth market.

- Dogs – Low market share in a low-growth market.

By placing products in these categories, businesses can make better decisions about where to invest, maintain, or divest.

Overview of Samsung’s Business Segments

Samsung operates across multiple industries. Its main business areas include:

- Consumer Electronics – Smartphones, TVs, home appliances.

- IT & Mobile Communications – Mobile devices, tablets, network systems.

- Semiconductors & Components – Memory chips, processors, sensors.

- Display Panels – OLED and LCD displays for TVs, monitors, and smartphones.

- Other Businesses – Smart devices, IoT, AI, 5G, and emerging technologies.

This diversity makes Samsung an ideal company to analyze using the BCG Matrix.

BCG Matrix of Samsung [Detailed Analysis]

Stars

Stars are business units with high growth and high market share. They require significant investment but also bring great returns.

For Samsung, the Stars include:

- Smartphones (Galaxy Series & Foldables): Samsung is one of the top players in the global smartphone market, constantly innovating with flagship and foldable devices.

- Semiconductors: Samsung is a global leader in memory chips and processors, which are in high demand due to AI, cloud computing, and data storage needs.

- Smart TVs and Display Panels: With cutting-edge OLED and QLED technologies, Samsung maintains strong leadership in this space.

These businesses are crucial for Samsung’s future growth and technological leadership.

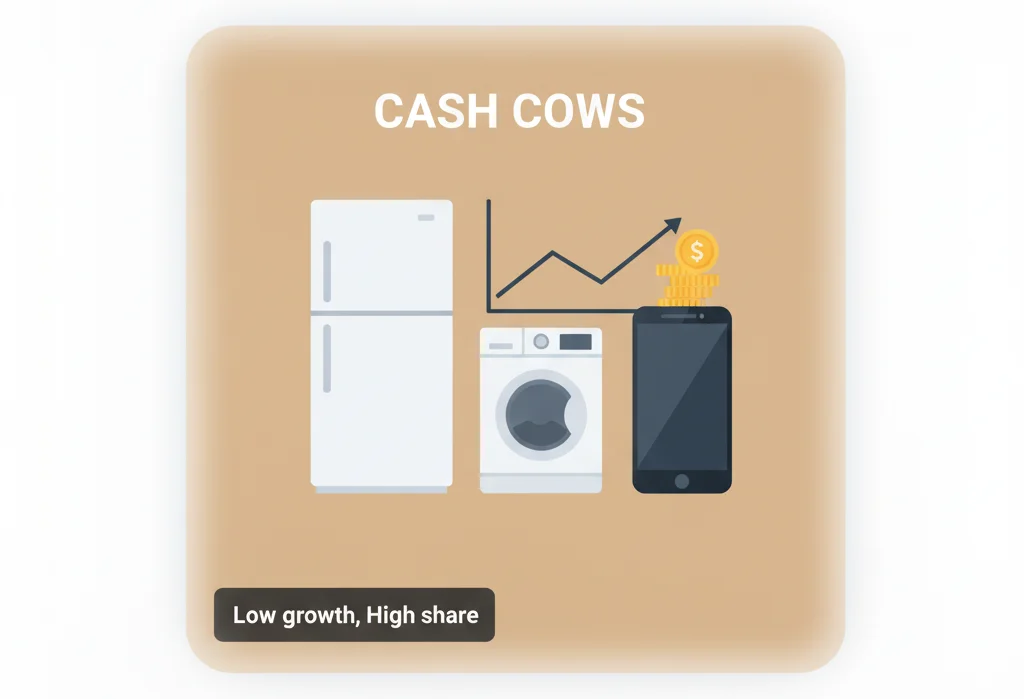

Cash Cows

Cash Cows represent high market share but low growth markets. They generate steady revenue with less need for investment.

For Samsung, Cash Cows include:

- Home Appliances: Products like refrigerators, washing machines, and air conditioners have stable demand worldwide.

- Feature Phones: Although smartphones dominate, basic models still sell well in developing markets.

- Consumer Electronics (Microwaves, Monitors): Mature markets with consistent revenue but limited growth.

These businesses provide Samsung with the financial strength to fund its Stars and invest in innovation.

Also Check: BCG Matrix of Amul [Detailed]

Question Marks

Question Marks operate in high growth markets but have low market share. They require significant resources, and their future is uncertain.

For Samsung, the Question Marks are:

- Smart Home Devices & IoT Ecosystem: While growing fast, competition from Amazon, Google, and Apple is strong.

- AI-driven Services and Software Solutions: Samsung is trying to expand beyond hardware into software and AI but hasn’t reached dominance yet.

- Wearables (Smartwatches, Galaxy Buds): These products are growing but still face heavy competition from Apple and other brands.

Samsung must decide whether to invest heavily in these areas or exit if they do not become profitable.

Dogs

Dogs are business units with low market share in low-growth markets. They neither generate significant profit nor hold much future potential.

For Samsung, Dogs include:

- Printer Business: Samsung sold this unit to HP after years of weak performance.

- Low-End Tablets: Struggling against cheaper Chinese brands in price-sensitive markets.

- Legacy Products (MP3 players, older devices): No longer relevant in today’s market.

Samsung has already exited or reduced focus on many of these areas.

Strategic Implications for Samsung

The BCG Matrix helps Samsung decide its future moves:

- Stars: Keep investing in smartphones, semiconductors, and display panels to maintain leadership.

- Cash Cows: Use steady profits from home appliances and consumer electronics to fund high-growth areas.

- Question Marks: Evaluate which emerging technologies (IoT, AI, wearables) can be turned into Stars and which should be divested.

- Dogs: Continue reducing focus on low-performing businesses and shift resources to more profitable areas.

Advantages of Using BCG Matrix for Samsung

- Helps identify profitable vs. underperforming business units.

- Ensures better resource allocation.

- Provides a clear strategic roadmap for short- and long-term growth.

Limitations of BCG Matrix in Samsung’s Case

While useful, the BCG Matrix also has limitations:

- It oversimplifies complex markets.

- Market share and growth rate are not the only success indicators.

- It cannot fully predict future technological disruptions or consumer preferences.

Conclusion

The BCG Matrix of Samsung reveals how the company manages its massive portfolio of products. Its Stars like smartphones and semiconductors drive innovation, while Cash Cows like home appliances ensure stable profits. Meanwhile, Samsung faces tough decisions on Question Marks such as IoT and wearables, and continues to exit from Dogs like printers.

By using strategic tools like the BCG Matrix, Samsung can balance innovation, profitability, and long-term growth in an increasingly competitive global market.

FAQs

1. What is the BCG Matrix and why is it important for Samsung?

The BCG Matrix helps Samsung identify which businesses to invest in, maintain, or divest for long-term growth.

2. Which Samsung products are considered Stars in the BCG Matrix?

Smartphones, semiconductors, and smart TVs are some of Samsung’s Stars.

3. What are Samsung’s Cash Cows?

Home appliances, feature phones, and consumer electronics fall under Cash Cows.

4. Why did Samsung exit the printer business?

The printer business had low growth and weak performance, making it a Dog.

5. How does the BCG Matrix help Samsung in decision-making?

It guides Samsung in resource allocation, strategic planning, and future investments.

Passionate about blogging and focused on elevating brand visibility through strategic SEO and digital marketing. Always tuned in to the latest trends, I’m dedicated to maximizing engagement and delivering measurable ROI in the dynamic world of digital marketing. Let’s connect and unlock new opportunities together!

![BCG Matrix of Samsung [Detailed]](https://admindia.org/wp-content/uploads/2025/09/BCG-Matrix-of-Samsung-Detailed.jpg)