Summary

The Microsoft BCG Matrix Analysis explores how one of the world’s most influential technology companies strategically manages its diverse product portfolio using the BCG Matrix—a powerful framework in strategic management.

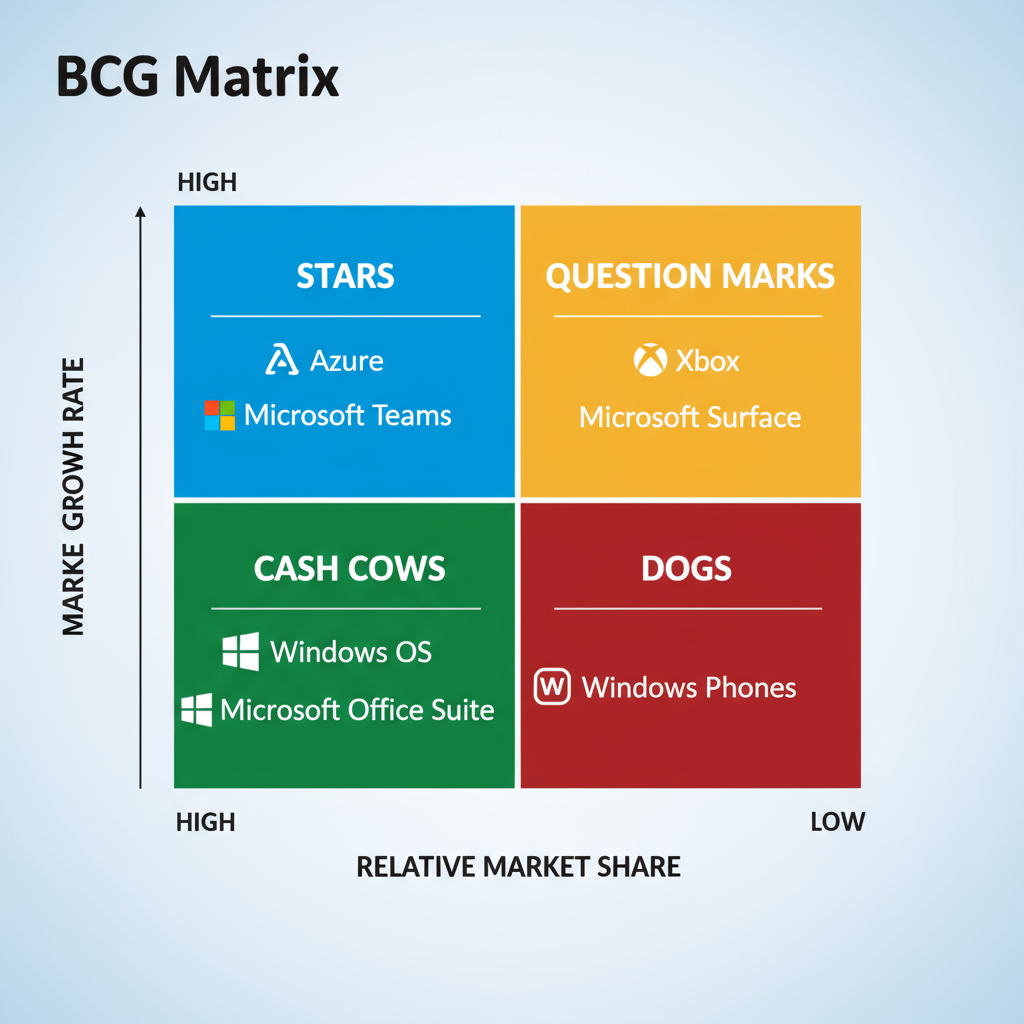

Through this detailed analysis, we’ll examine how Microsoft’s products like Azure Cloud Platform and Microsoft Teams fit into the “Stars” quadrant, why Windows OS and Microsoft Office Suite remain “Cash Cows,” how Xbox and Surface Devices stand as “Question Marks,” and why Windows Phones were classified as “Dogs.”

Every successful company faces one universal challenge — how to use its limited resources wisely to get the best return. In today’s dynamic marketplace, where technologies change overnight, strategic decision-making becomes the key to long-term survival.

Microsoft, one of the most valuable companies in the world, operates across numerous industries — software, cloud computing, hardware, gaming, and AI. But how does Microsoft decide which products deserve heavy investment and which ones should be scaled down or discontinued?

The answer lies in a simple yet powerful business framework — the BCG Matrix (Boston Consulting Group Matrix).

This analytical model, part of the core concepts in strategic management, helps companies evaluate their product lines based on two critical factors:

- Market Growth Rate, and

- Market Share.

By categorizing products into four groups — Stars, Cash Cows, Question Marks, and Dogs — the BCG Matrix provides a visual roadmap for how to allocate resources effectively.

In this blog, we’ll explore the Microsoft BCG Matrix Analysis in detail, explaining each quadrant with examples, business implications, and lessons that other companies can learn from Microsoft’s strategy.

Background of Microsoft

Founded on April 4, 1975, by Bill Gates and Paul Allen, Microsoft’s journey began in Albuquerque, New Mexico. What started as a small tech venture soon became the cornerstone of personal and enterprise computing.

1. The Early Years

Initially, Microsoft focused on creating software interpreters for microcomputers — particularly for the Altair 8800. Gates and Allen envisioned a world where every desk would have a computer, and Microsoft would provide the operating system that powered it.

This vision materialized in 1980, when IBM approached Microsoft to develop an operating system for its new personal computers. The result was MS-DOS, a simple yet revolutionary platform that made Microsoft a household name.

2. Evolution and Expansion

As the computing landscape evolved, Microsoft expanded aggressively into:

- Software (Windows OS, Microsoft Office Suite)

- Hardware (Surface devices, Xbox consoles)

- Cloud Computing (Azure Cloud Platform)

- Digital Services (Microsoft Teams, LinkedIn, OneDrive, GitHub)

Over the decades, Microsoft diversified beyond software into AI, cybersecurity, and cloud-based enterprise solutions, positioning itself as a global technology leader.

3. Competitive Landscape

Despite its dominance, Microsoft faced challenges from tech rivals such as Apple, Google, and Amazon. Each competitor disrupted a part of Microsoft’s empire — Apple with design-centric hardware, Google with cloud-based productivity tools, and Amazon with AWS cloud dominance.

However, Microsoft’s resilience came from its strategic adaptability — continuously evaluating its portfolio, investing in innovation, and discontinuing underperforming products. This adaptability is best visualized through the BCG Matrix in strategic management.

What is the BCG Matrix?

Before analyzing Microsoft’s case, it’s essential to thoroughly understand what the BCG Matrix is, how it works, and why it has become a cornerstone of strategic management and corporate planning.

The BCG Matrix, short for the Boston Consulting Group Growth-Share Matrix, is a strategic framework that helps companies evaluate their product or business portfolio based on two critical dimensions:

- Market Growth Rate (which represents the potential and attractiveness of an industry), and

- Market Share (which indicates a company’s competitive strength within that industry).

By combining these two metrics, the BCG Matrix helps organizations visualize which products or business units are driving growth, which are generating stable income, and which might be consuming resources without adequate returns.

This model was originally developed by Bruce Henderson, the founder of the Boston Consulting Group, in the 1970s, and it remains one of the most widely used strategic analysis tools even today.

The Four Quadrants of the BCG Matrix

The matrix divides a company’s offerings into four categories:

- Stars – High market share and high market growth.

- Cash Cows – High market share but low market growth.

- Question Marks – Low market share but high market growth.

- Dogs – Low market share and low market growth.

Each quadrant suggests a different business strategy.

3. The Axes Explained

- Market Share (Horizontal Axis): Indicates competitiveness and dominance.

- Market Growth Rate (Vertical Axis): Represents potential and attractiveness of the industry.

In strategic management, companies use this framework to achieve a balanced portfolio — combining stable revenue-generating products with high-potential innovations.

Microsoft BCG Matrix Analysis

Microsoft’s product portfolio fits perfectly within the BCG Matrix framework. From its globally dominant Windows OS to its innovative Azure cloud services, each product plays a distinct role in the company’s strategy.

Let’s analyze Microsoft’s products across all four quadrants.

1. Stars – Microsoft’s Growth Engines

The Stars quadrant contains products with both high market growth and high market share. These are the company’s future revenue powerhouses. They are profitable but demand high investment to maintain dominance.

a. Microsoft Azure Cloud Platform

Azure is at the heart of Microsoft’s transformation from a software company to a cloud computing powerhouse. Competing with Amazon Web Services (AWS) and Google Cloud Platform (GCP), Azure offers services like AI tools, data storage, virtual computing, and app hosting.

Why Azure is a Star:

- The cloud industry is growing rapidly, with businesses shifting to digital and remote infrastructure.

- Azure holds a strong market position, second only to AWS.

- It’s a major revenue driver, accounting for over 40% of Microsoft’s total profits.

Strategic Importance:

Azure represents Microsoft’s long-term future. The company continuously invests in data centers, AI integration, and cybersecurity to maintain competitiveness. Its ecosystem supports corporations, startups, and governments alike.

In strategic management terms, Azure is both a Star and a strategic pillar— fueling innovation and recurring revenue.

b. Microsoft Teams

Microsoft Teams, launched in 2017, revolutionized business communication. Integrated within Microsoft 365, Teams combines chat, video meetings, file sharing, and collaboration tools into one seamless platform.

Why Teams is a Star:

- Explosive growth during the remote work boom.

- Deep integration with other Microsoft tools like Outlook, SharePoint, and OneDrive.

- High adoption among enterprises, educational institutions, and governments.

Strategic Insight:

Microsoft continues to enhance Teams with AI-driven features, third-party app integrations, and security updates. Competing with Slack, Zoom, and Google Meet, Teams holds a major share of the enterprise collaboration market.

Investment Outlook:

Teams requires continuous development and marketing investment, but its role as a collaboration hub ensures long-term growth.

2. Question Marks – The High-Potential Contenders

Question Marks represent products with low market share but high market growth potential. They are promising but risky — needing strategic evaluation.

a. Surface Devices

Microsoft’s Surface line (Surface Pro, Surface Laptop, Surface Studio) bridges software and hardware innovation. Designed to rival Apple’s MacBook and iPad, Surface products emphasize portability, style, and performance.

Why Surface is a Question Mark:

- Competes in a fast-growing hardware market.

- Has a loyal but niche customer base.

- Faces tough competition from Apple and Dell.

Strategic Challenge:

To move Surface into the Star quadrant, Microsoft must:

- Expand hardware innovation.

- Offer competitive pricing.

- Integrate Surface more deeply into the Microsoft ecosystem.

While Surface hardware is admired for design and technology, it needs stronger marketing and manufacturing strategies to increase market share.

Also Read: BCG Matrix of Tata Motors

b. Xbox Gaming Consoles

The Xbox is Microsoft’s flagship gaming division, competing against Sony PlayStation and Nintendo Switch. With Xbox Game Pass, Microsoft introduced a subscription-based gaming model that changed the industry’s economics.

Why Xbox is a Question Mark:

- Gaming is a high-growth industry, but Xbox’s share fluctuates.

- Faces competition in exclusives and user base.

- Requires heavy investment in game development and partnerships.

Strategic Perspective:

Microsoft’s acquisition of Activision Blizzard in 2023 aims to strengthen Xbox’s position by adding blockbuster titles. If successful, Xbox could transition into the Star category.

However, profitability remains inconsistent due to high R&D and competition. Thus, Xbox stays in the Question Mark quadrant — full of potential but needing stronger market capture.

3. Cash Cows – Microsoft’s Financial Backbone

Cash Cows are the company’s most profitable yet mature products — high market share but slow market growth. They generate cash that funds new innovations.

a. Windows Operating System

Windows remains Microsoft’s backbone, dominating the global OS market with over 70% market share. From Windows XP to Windows 11, the platform continues to power millions of personal and enterprise computers.

Why Windows is a Cash Cow:

- Stable and massive user base.

- Generates steady licensing revenue.

- Acts as a foundation for other Microsoft services.

Strategic Role:

Though the personal computing market is mature, Microsoft keeps the Windows brand relevant by adding features like AI-powered Copilot and seamless integration with Azure and Office.

Windows’ predictable cash flow allows Microsoft to invest aggressively in future technologies such as AI, metaverse, and cybersecurity.

b. Microsoft Office Suite

The Microsoft Office Suite, which includes Word, Excel, PowerPoint, and Outlook, has been the gold standard for productivity tools for decades. Its evolution into Microsoft 365 ensured continued relevance in the cloud era.

Why Office is a Cash Cow:

- Dominant market share in office productivity.

- Reliable subscription-based revenue model.

- Continuous upgrades (cloud-based collaboration, AI assistants).

Strategic Role:

Office 365’s SaaS transformation keeps it profitable while supporting the ecosystem around Teams and OneDrive. It provides stable cash flow to finance Microsoft’s innovations.

Even as competitors like Google Workspace emerge, Microsoft’s enterprise trust and integration advantage ensure its cash cow status.

4. Dogs – The Declining Ventures

Dogs are products with low market share and low market growth. They often consume resources without contributing much to profitability.

a. Windows Phones

Perhaps Microsoft’s most notable strategic misstep, the Windows Phone serves as a perfect “Dog” example. Launched to rival Android and iOS, it struggled to gain traction despite innovative features.

Reasons for Decline:

- Weak app ecosystem.

- Late entry into the mobile market.

- Insufficient developer support.

- Poor marketing compared to Apple and Samsung.

Strategic Decision:

In 2017, Microsoft discontinued manufacturing Windows Phones, and by 2022, all support was officially ended.

Lesson Learned:

The discontinuation showcased Microsoft’s strategic maturity — understanding when to exit a losing battle and redirect resources toward profitable ventures like Azure and AI.

The Windows Phone experience underscores a key principle of the BCG Matrix in strategic management: sometimes, divestment is the most strategic decision.

Key Takeaways from the Microsoft BCG Matrix

- Balanced Portfolio = Strategic Stability

Microsoft maintains a healthy balance between mature, profitable products and innovative, high-growth ventures. - Continuous Innovation Keeps Giants Relevant

Even Cash Cows like Windows and Office undergo regular reinvention, ensuring Microsoft’s dominance doesn’t fade. - Risk Management Through Diversification

By investing across cloud computing, hardware, gaming, and AI, Microsoft avoids overdependence on any one market. - Strategic Agility Is Essential

The decision to end Windows Phones shows Microsoft’s adaptability and willingness to evolve with market realities. - Data-Driven Investment Decisions

Microsoft’s use of portfolio analysis ensures that every investment aligns with growth potential and long-term profitability.

Conclusion

The Microsoft BCG Matrix Analysis is a masterclass in strategic resource allocation and portfolio management.

Microsoft’s ability to balance high-growth innovations (Azure, Teams) with stable profit generators (Windows, Office) while phasing out underperforming products (Windows Phones) demonstrates world-class strategic management.

The company’s dynamic approach to investment, innovation, and divestment has kept it ahead of competition for nearly five decades.

For businesses and marketers, this analysis highlights a key insight:

➡ Success doesn’t come from having only high-growth products, but from balancing innovation with profitability.

By adopting the BCG Matrix, companies can identify where to focus, what to maintain, and what to let go — ensuring long-term sustainability.

FAQs

What is the BCG Matrix in simple terms?

The BCG Matrix is a business framework that categorizes a company’s products into four groups—Stars, Cash Cows, Question Marks, and Dogs—based on market share and growth rate.

What are Microsoft’s Stars in the BCG Matrix?

Microsoft Azure and Microsoft Teams are the Stars, both holding strong market positions and significant growth potential.

Why are Windows and Office Suite called Cash Cows?

Because they generate consistent, long-term revenue with minimal investment, providing financial stability for Microsoft’s innovations.

What are Microsoft’s Question Marks?

The Surface Device series and Xbox consoles are Question Marks — they have high growth potential but currently lower market share.

Why did Windows Phones fail?

Limited app support, strong competition, and late market entry led to the decline of Windows Phones, ultimately placing them in the “Dogs” quadrant.

How does the BCG Matrix help in strategic management?

It helps managers allocate resources effectively, identify growth areas, and maintain a balanced product portfolio.

Is the BCG Matrix useful in marketing?

Yes. The BCG Matrix in marketing helps brands decide which products to promote, where to invest marketing budgets, and which to phase out.

What can businesses learn from Microsoft’s BCG Matrix?

Businesses can learn to diversify, innovate continuously, and make tough decisions about discontinuing non-performing products.

A digital marketer with a strong focus on SEO, content creation, and AI tools. Creates helpful, easy-to-understand content that connects with readers and ranks well on search engines. Loves using smart tools to save time, improve content quality, and grow online reach.